Plaid Available through Dwolla’s Open Banking Services (Beta)

A beta version of Instant Account Verification (IAV) and Balance Check from Plaid are now available through Dwolla’s Open Banking Services! Dwolla has integrated Plaid's Instant Account Verification (IAV) and Balance Check capabilities into Dwolla's pay by bank platform. This enables customers to onboard with Plaid through Dwolla’s Open Banking Services, providing a single vendor and single API solution for mid- to enterprise-sized businesses.

If you’re interested in participating in the beta or learning more about using Plaid through Dwolla, you can:

- Reach out to your account manager or relationshipmanagement@dwolla.com if you already have an account with Dwolla.

- Reach out to our sales team to schedule a payments consultation and explore how our solution could work for your use case.

DASHBOARD

Transfer Tracking Made Easy

Previously, to view the details of a transfer, clients had to look at each individual leg of that transfer separately. Since transfers typically involve the Dwolla digital wallet and at least one external bank account, clients were required to click back and forth between several Transfer Detail pages to identify payment issues and the current location of the funds. Now, with the Funds Flow Overview page, clients can see the details about every leg of a transfer at a glance on a single page.

This consolidated view makes it easier to identify issues or delays in transfers and understand the current status of the funds involved. By viewing each leg of the transfer, clients can easily see the Transfer ID, Amount, Status and Dates. If a leg failed, they can also review the reason.

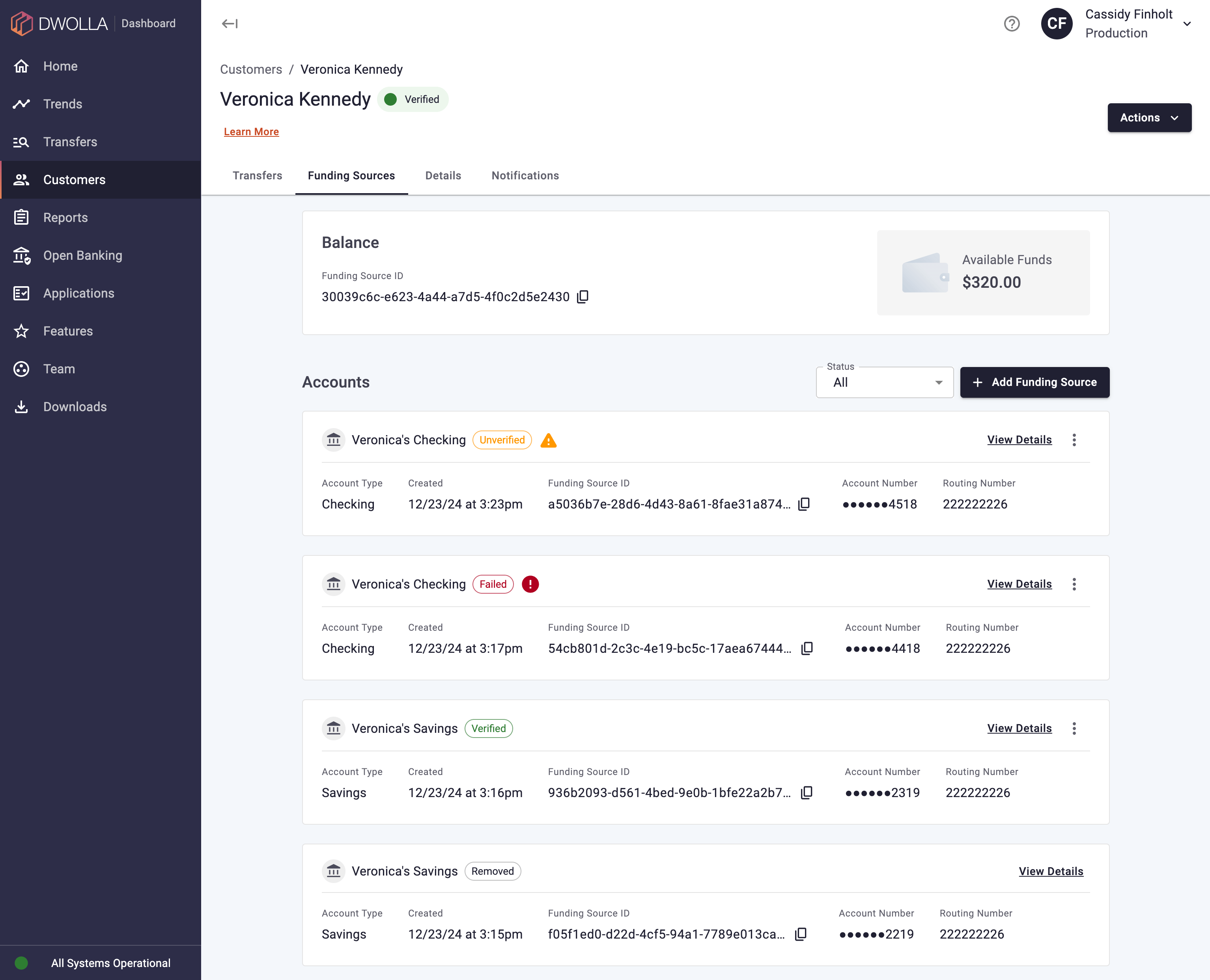

Improved Funding Sources Section

We’ve made significant improvements to the Customer Funding Sources section of the Dwolla Dashboard! This update is designed to provide clients with a clearer, more detailed and more user-friendly view of the bank accounts their end users have added through Dwolla.

What's new?

- Enhanced Layout: We've redesigned the layout to better accommodate users with multiple bank accounts. The new list view provides a more efficient way to view and manage end users’ accounts.

- Additional Details: We've added Routing Number and Masked Account Number to each account. This information will help clients more easily identify funding sources.

- Improved Status Indicators: We've enhanced the funding source status indicators to provide more clarity on the verification status of each funding source. This will help clients quickly identify accounts that require attention, such as those awaiting micro-deposit verification.

- Additional Information: Clients can now view more details about funding sources and associated webhooks directly within this section.

BALANCE

Form 1099-Ks for Tax Year 2024 Now Available

For clients and end users who have already provided their tax information, Form 1099-Ks for tax year 2024 were distributed in early January. If you or your end users meet the IRS reporting thresholds for Form 1099-K but have not yet provided your tax information, please do so as soon as possible to ensure timely delivery of your Form 1099-K. You can find more information on our Understanding Form 1099-K page.