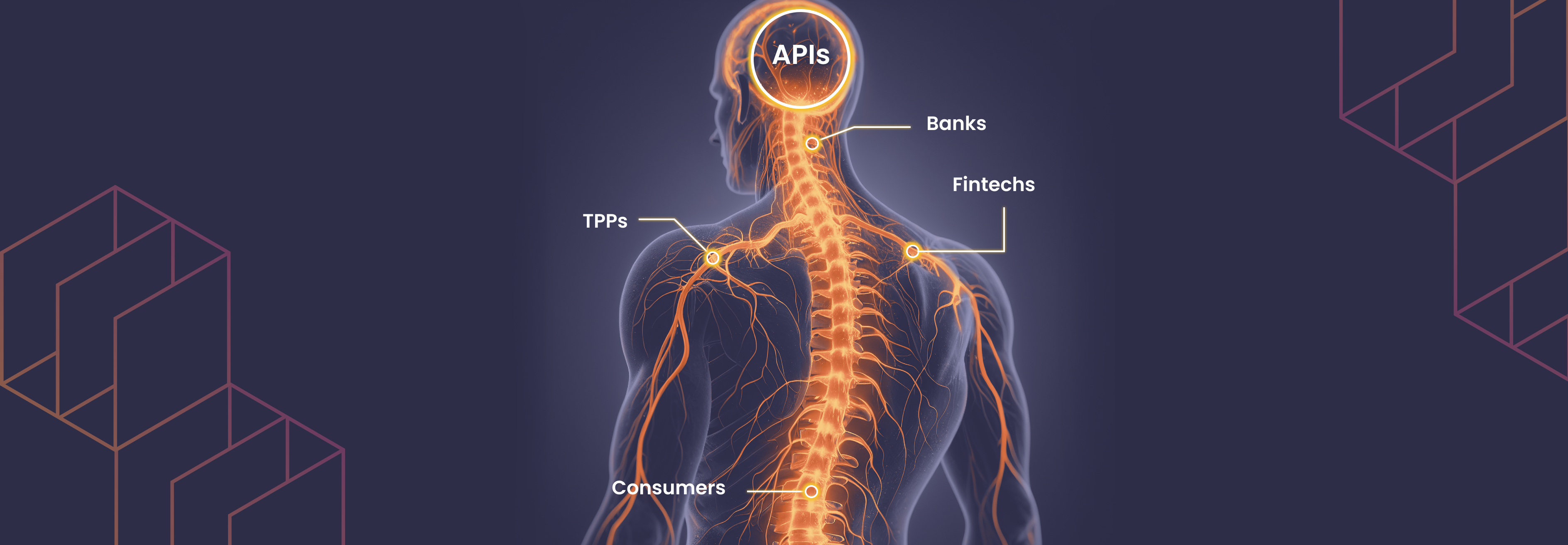

The payments landscape is undergoing a massive shift, driven by the rise of open banking. Payment APIs like Dwolla’s play a crucial role in the open banking ecosystem, acting as the bridge between diverse participants and enabling innovative payment experiences. The open banking ecosystem brings together a wide range of players—banks, third-party providers (TPPs), fintechs/businesses and consumers. So, who stands to benefit out of all of these players? Everyone!

Imagine that banks, third-party payment service providers, fintechs, and consumers represent vital organs. Each has its own function, but for the organism they support to thrive, they all need to communicate seamlessly. Open banking fosters an ecosystem of collaboration where data flows freely and securely. This unlocks a world of possibilities, empowering both consumers and businesses. This is where APIs come into the picture. They act as the central nervous system of open banking communication, making them crucial to success.

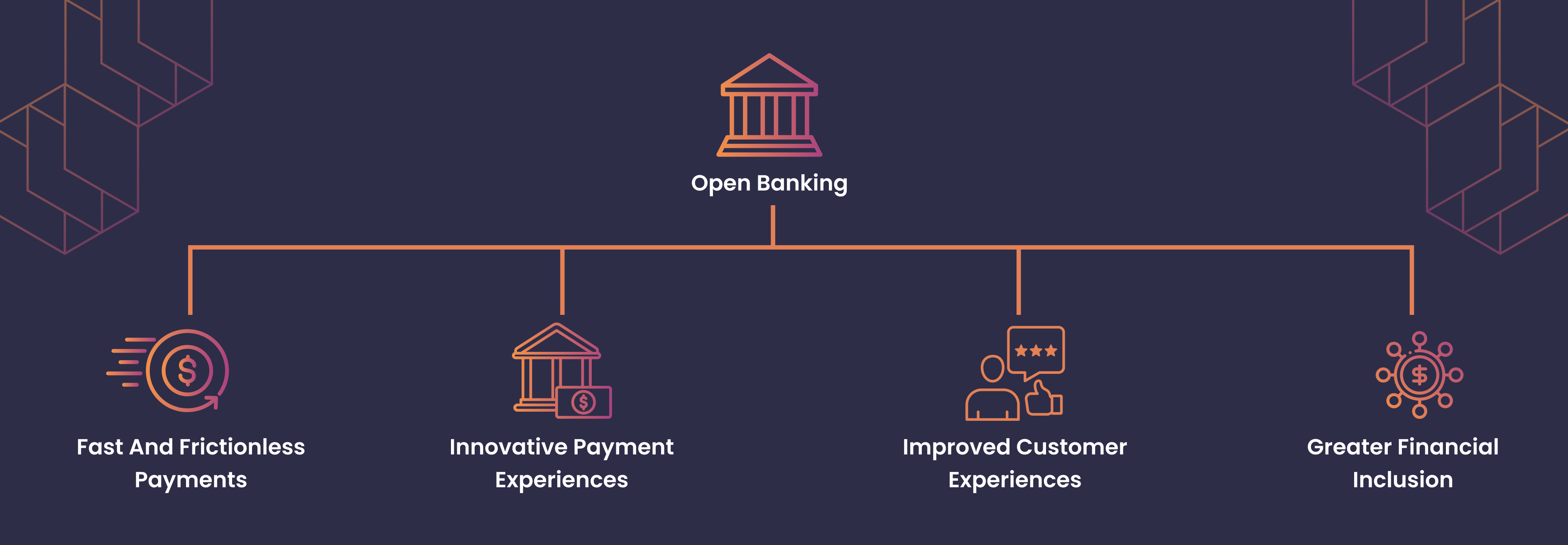

Why is Open Banking important for payments?

Consider a financial landscape with:

- Fast and frictionless payments: Forget waiting days for checks to clear or manually entering routing numbers. With open banking, businesses benefit from more efficient cash flow management and faster payments. Open banking empowers innovators to transform account-to-account transfers (A2A) (also known as pay by bank), streamlining the way consumers and businesses send and receive funds.

- Innovative payment experiences: Open banking fosters a fertile ground for creativity, paving the way for novel payment solutions like automated bill payments, data-driven budgeting tools and more ways to enhance business performance.

- Improved customer experiences: Applications can leverage open banking data to provide users with tailored financial insights and recommendations. This empowers individuals to take control of their finances and make informed decisions, resulting in improved customer satisfaction.

- Greater financial inclusion: Open banking can enable businesses to expand access to financial services for underserved populations. The data can be used to better assess risk and potentially open doors for those who may have been excluded from traditional financial services in the past.

The benefits of open banking are immense and pave the way toward a more innovative, secure and user-friendly experience. It’s important to note that in order for the ecosystem to collaborate effectively, its participants need to establish trust in how they communicate and share information with each other.

Secure Exchange Solution: Building Trust in Open Banking

Before diving into direct integrations, we recognized the critical need to establish a foundation for robust security. This led to the Secure Exchange Solution, which we believe is a crucial cog in developing the open banking landscape. This innovative technology utilizes tokenization, a process that replaces sensitive financial data with unique tokens during communication.

These tokens act as secure “keys,” allowing authorized applications to access sensitive information without exposing the actual data. In support of a more secure open banking ecosystem, this approach significantly reduces the attack surface and fosters a more secure open banking ecosystem. For a deep dive into the Secure Exchange Solution, check out our dedicated blog post here.

Open Banking Services: The Future of Open Banking is Collaborative

Building upon the foundation of the Secure Exchange Solution, we've focused on pre-built/embedded integrations with leading open banking providers. Traditionally, integrating with each platform individually could be a cumbersome and time-consuming process, requiring developers to navigate different APIs, data formats and authentication protocols. This not only increased the development time for integrating businesses but increased the maintenance overhead.

Dwolla's pre-built solutions eliminate this burden, acting as a one-stop shop for seamless open banking services and embedded payments.

Here’s how these open banking pre-integrations empower you:

- Access a wider range of data: At launch, we’ll focus on the use case of account verification for the purposes of initiating pay by bank transactions. However, the product capabilities will expand to leverage a broader data landscape, encompassing account information (balances, account types), transaction history and more to create richer financial experiences.

- Reduce development time: Streamline integrations through pre-built connections, freeing up valuable resources for innovation.

- Focus on functionality: Dedicate your time and expertise to building the core functionalities of your application rather than managing complex integrations.

Understanding The Process

How do these pre-built integrations work? Think of pre-built integrations as universal translators for open banking. They eliminate the need for your application to understand the API call structure and elements (endpoint, headers, data formats, etc.) for each individual platform. Instead, these integrations act as a middle layer, seamlessly converting this information into a consistent format your application can easily comprehend.

Here's how it works:

- Connecting to the Open Banking Provider: Your application initiates the process by establishing a secure connection with the open banking provider. Dwolla creates a new resource type called “Exchange Sessions” which facilitates the process of account linking.

- Account Linking with User Consent: Based on a URL generated via an Exchange Session, an account linking flow within your application’s UI prompts the user to authenticate and authorize access to their bank account data.

- Secure Token Exchange: Once the user authorizes access, a secure "token" is exchanged. This token allows Dwolla to access the open banking provider's API on your behalf—without ever needing the user's actual login credentials.

- Taking Action: With this secure tokenized access, your application can then perform various actions within the Dwolla API, such as adding and verifying the user's bank account for a seamless transfer of funds in account-to-account payments.

This streamlined process, powered by pre-built integrations, ensures a smooth and secure experience for both you and your users when interacting with open banking data, further enhancing your digital payment processes and pay by bank transactions.

Architectural Advantage: Single API for Scalable Open Banking

Dwolla's API utilizes a well-designed, scalable, uniform architecture. This allows us to seamlessly integrate with multiple open banking platforms while maintaining a single API approach and translates to several key benefits for developers:

- Reduced complexity: Manage a single API for all your open banking needs, regardless of the chosen platform. This simplifies development, maintenance and debugging.

- Simplified and seamless integration: Utilize consistent API calls and structures for all integrations, minimizing the learning curve and streamlining the development process.

- Tailored solutions: Leverage pre-built integrations and the single API to tailor functionalities to your specific business needs. This allows you to create solutions that expand your business model and perfectly align with your unique use cases, offering greater control and flexibility. If you want to integrate multiple financial account aggregators into your services, the interface remains consistent, allowing you to switch easily or utilize multiple providers at the same time.

Think of it this way: Building an account-to-account payments solution (also known as pay by bank) with Dwolla is like constructing a Lego house from scratch, sourcing each component individually from different packages. Dwolla, however, now provides you with a large component of the house pre-packaged in a single platform. This provides access to a greater range of features and leads to significant savings in development time and resources.

The Future of Dwolla's API: Expanding the Open Banking Landscape

We are constantly innovating and looking towards the future of open banking. Here's a glimpse of what we have on our radar:

- Expanding data access: We're committed to providing access to even richer and more diverse data sets through deeper embedded integrations—data such as account balances, fraud and risk indicators, and identity verification. This will empower you to build sophisticated financial products and services that cater to a wider range of user needs.

- Exploring faster account verification: Both the RTP Network® (from The Clearing House) and the FedNow® Service (from the Federal Reserve) can be used for faster account verification through a process called instant microdeposits. The acknowledgment of the receipt of microdeposits nearly instantly verifies that the account information provided by the customer is accurate and operational. Learn more about the benefits of instant payments in this blog.

- Standardization advancements: Ongoing efforts will further refine and standardize API and security protocols across the open banking ecosystem, ensuring even smoother communication.

- Simplified compliance: Navigating payment regulations can be complex, especially as online payment options continue to evolve. We're exploring ways to integrate solutions that simplify compliance, enabling faster onboarding and allowing you to focus on building innovative applications with fewer hurdles.

- Enhanced developer experience: We understand the importance of empowering developers. We're continuously improving our tools, developer documentation and resources to provide you with everything you need to succeed in the open banking space. We’re also exploring how the use of AI can help developers find the information they need more easily and assist us in getting needed developer resources and tools created and published more quickly.

What excites us most? We believe Dwolla's API, in conjunction with open banking, holds immense potential for the future of payments. By offering a secure, scalable and developer-friendly solution, we aim to empower you to build the next generation of innovative services leveraging account-to-account payments. Join us on this journey as we shape the future of electronic payments together!

Want to learn more about open banking? Read the latest Financial Tech Times article from our CEO, Dave Glaser: Unlocking Efficiency and Security: The Importance of Open Banking for A2A Payments