Automate Your Payments with Standard ACH

Move funds in and out of external bank accounts, using standard ACH processing times.

The Benefits of Automated ACH

Businesses of all sizes are moving beyond paper checks and outdated file-based systems to embrace the efficiency of modern ACH transactions. Dwolla's platform facilitates seamless ACH payment automation, eliminating manual processes and reducing errors.

Lower Costs

Cut expenses and boost your bottom line with ACH payment automation. By automating business ACH payments, you can reduce transaction fees, minimize labor costs associated with manual processing, and accelerate incoming payments.

Increased Security

Safeguard your funds with secure ACH transfers. Automated ACH transactions offer superior protection against fraud and errors compared to credit cards, manual check processing and legacy ACH files.

Controlled Cash Flow

Take control of your cash flow with automated ACH. Eliminate manual processes and gain greater visibility into your payments.

“The time the team had previously used to manually process transactions was drastically reduced and there was no need to hire more personnel for other activities. Our manual workload decreased by 98% and the total time spent on transactions reduced by 80%—along with all of the errors that were prevented—thanks to automating ACH transactions.”

Transportation CompanyChief Executive Officer

How Standard ACH Works

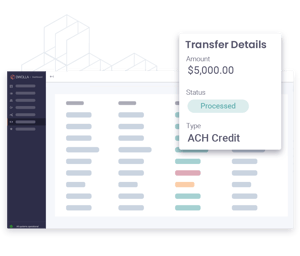

Standard ACH is the default automated processing option for bank transfers, requiring no additional setup or configuration. Any transfer created will automatically follow the standard clearing time. It applies to both ACH payment in (debit) and ACH payment out (credit) transfers.

Key Points to Note for Standard ACH Transfers:

- Export deadline: Approximately 4 p.m. Central Time

- Transfer processing time:

- Debit transfers: 3-4 business days

- Credit transfers: 1-2 business days

- Processed on business days (processing unavailable on weekends and banking holidays)

- Learn more about Dwolla's transfer timelines in our developer documentation.

Insurance Platform Uses ACH Payments for Efficient Claim Reimbursement

- A pet insurance platform started searching for a more efficient reimbursement solution to help scaling efforts. This platform onboards thousands of policyholders on a monthly basis

- Partnering with Dwolla and implementing ACH payments has allowed their customers to claim reimbursements 5 days faster than with a paper check.

- Electronic ACH payments saved this insurance company over 92% in costs vs. paper checks.

- Reimbursement efficiencies improved by over 800% by switching from paper checks to ACH.

Investment Platform Facilitates Art Buying with ACH transactions

- An investment platform uses standard ACH transaction timing not only as a check against fraud but also as a peace-of-mind payment method that lets them know how much money is in the bank and when it will arrive.

- Since going live with Dwolla, this Investment platform went from transferring “a couple hundred thousand dollars” through the Dwolla Platform to facilitating tens of millions a month in art investments.

- For their end users, having the ability to make a quick and easy investment is a significant step in making art acquisition more accessible. The flexibility and ease of ACH payments with Dwolla means the API works in the background with little to no intervention from the company’s engineers.

- Their payment volumes scaled by 200% using ACH transactions.

Real Estate Platform Uses ACH for Inexpensive, Quick and Reliable Payments

- Real estate companies and escrow holders use this platform to collect earnest money deposits and commissions electronically, eliminating the need to manually deliver paper checks or conduct real estate transactions in person.

- When this real estate platform first implemented Dwolla’s payment API, the company used standard ACH transaction timing to facilitate real estate payments.

- The technology team can easily toggle between Standard ACH and Same Day ACH transfers, depending on the end user, risk factors or use case.

Automate your payments in as little as ten days.

Dwolla's full-service approach replaces legacy payments technology with a single solution, improving security, data visibility and the customer experience.