Streamline Your Payments with Same Day ACH

The Benefits of Automated ACH

Collecting and disbursing payments is a critical piece of a business’s payment operations. From mid-sized businesses to large corporations, every business can benefit from streamlined payment processing technology.

Same Day ACH transfers are a highly adopted transfer speed among businesses using ACH for payments. Whether your business is looking to expedite payroll, provide faster crediting to prevent late bill payments or improve the speed of payments between businesses, implementing Same Day ACH functionality makes funds available faster.

How Same Day ACH Works

Same Day ACH allows you to move money electronically within the same business day (excluding weekends and holidays).

The ACH network typically processes batches of transactions once or twice a day, resulting in clearing times of several business days. Same Day ACH builds upon this existing infrastructure by introducing additional processing windows throughout the day. This allows for funds to be received by the destination bank on the same business day that the transfer is initiated, provided it meets the specific deadline set by the originating financial institution.

FinTech Platform Uses Same Day ACH to Transfer Tips for Stylists and Shop Owners

- This tipping platform’s card transactions were cutting into profits for stylists and shop owners.

- They partnered with Dwolla to lower transaction costs with reliable processing times using Same Day ACH.

- The tipping platform saw an 86% increase in transaction volume after implementing Same Day ACH.

Transportation Company Automates its Payment Operations, Allowing Cargo to Move Faster

- Before Dwolla, this transportation company’s payment processes were completed manually. They didn’t need to work harder, they just needed a smart API solution to help them improve their processes.

- By implementing automated ACH, they decreased their manual workload by 98%.

- Reducing their manual workload resulted in a better customer experience overall and the return on investment was almost immediate.

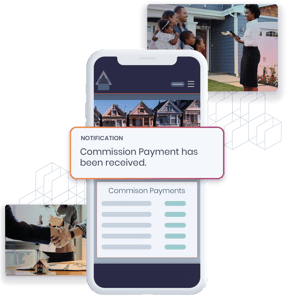

Real Estate Platform Uses ACH for Inexpensive, Quick and Reliable Payments

- Real estate companies and escrow holders use this platform to collect earnest money deposits and commissions electronically, eliminating the need to manually deliver paper checks or conduct real estate transactions in person.

- When this real estate platform first implemented Dwolla’s payment API, the company used standard ACH transaction timing to facilitate real estate payments.

- When clients started requesting faster payment options, the platform added Same Day ACH payments to their suite of features.

After adding Same Day ACH transactions, they experienced 212% growth in new client contracts, 376% growth in payment transactions and 483% growth in the dollar amount of funds transferred through the platform. - The technology team can easily toggle between Standard ACH and Same Day ACH transfers, depending on the end user, risk factors or use case.

Automate your payments in as little as ten days.

Dwolla's full-service approach replaces legacy payments technology with a single solution, improving security, data visibility and the customer experience.